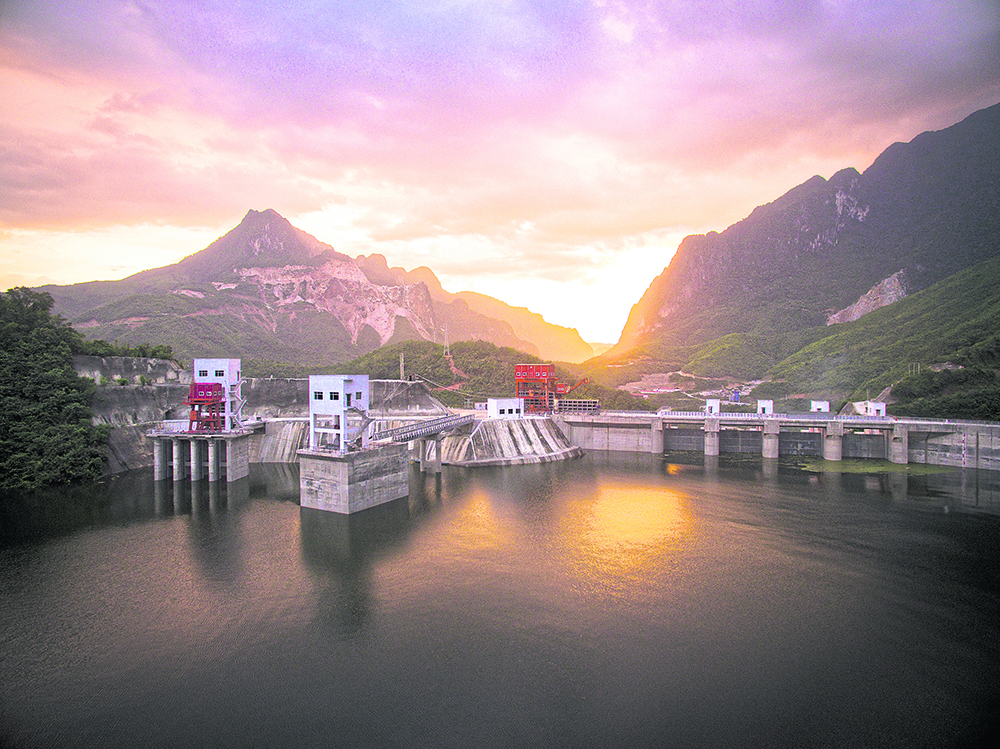

Renewable energy is growing in importance and popularity, EDL-Generation Public Company (EDL-Gen), with over 50 years’ experience working in clean power supply in Lao People’s Democratic Republic (Lao PDR)

with state-owned Électricité du Laos, before its separation and subsequent incorporation in 2010, is striding to boost its capital fund from independent power producers (IPP) offshore under its generation capacity expansion plan. With Thailand as a potential connector among Greater Mekong Sub-region (GMS) countries, EDL-Gen is set to thrive as a leading electricity exporter among ASEAN countries, attesting to its well-deserved handle, “The Battery of Asia”.

Vanhseng Vannavong Deputy Managing Director and CFO of EDL-Gen

Mr. Vanhseng Vannavong, Deputy Managing Director and CFO of EDL-Gen, recently commented on the company’s successes as at year-end. He revealed that despite the global pandemic and its resurgence, “EDL-Gen’s ongoing plan is to expedite the addition of new power plants across Lao PDR. With current generating capacity of 1,949 megawatts, we are now targeting a 20% increase to approximately 2,435 megawatts by end-2030,” he said.

“Generation of renewable energies is virtually obligatory at this point due to climate change and global pollution. Through our concession contract, we have a clear edge on operational duration which allows us to capitalise on options for long-term investment. Since energy trading, unlike traditional financial markets, proceeds through wholesale arrangements, there is no concern about having to bid an attractive price against other manufacturers.”

“Once ready, our product will be distributed to our contracting parties, currently comprising Thailand, Cambodia, Vietnam, Myanmar, and Malaysia in accordance with each existing MoU framework,” Mr. Vanhseng elaborated. “Contract-wise, it is safe to say, the future path is already well-paved for us so we can move forward with alacrity.”

“Our power plant reservoirs are spread across the countries which reduces exposure to certain uncontrollable seasonal risks that may arise such as unexpected drought and shortage of rainfall that might be a problem if we concentrated all our power plants in a single region,” the CFO added.

As for the environmental impacts, Mr. Vanhseng confided, “Our generation methodology deploys hydroelectric power which produces electricity through the force of current rushing through a pipe, then pushing against and spinning blades in a turbine. As such, there is zero emission of greenhouse gases and toxins and there’s no sediment that might be harmful to forests or plantations.”

“Our mission not only covers environmental conservation but also

endorses social engagement. We keep in mind the necessity of engaging with local communities. Our employees have more or less tripled within the decade since EDL-Gen first got started. The majority of our employees are locals living nearby each of the operations sites. They are inherently eco-conscious about keeping their home region environmentally intact and we have further nurtured and developed this.”

Though already partially executed, “The Battery of Asia” pursuit may have a few more moves to make to become the leading exporter of Clean Energy Power to the ASEAN region. Inevitably, construction of water reservoirs requires substantial funding. As such, the company foresees the opportunity to seek offshore funding to accommodate the early stage financial demands, as it successfully did in the past.”

Mr. Adisorn Singhsacha, founder and CEO of Twin Pine Group (Twin Pine), an independent advisory services company experienced in GMS business development, expressed his trust in the potential of EDL-Gen, saying: “Among the GMS countries, Lao PDR has the highest potential to develop as a leading renewable energy exporter due to the relationship of its geography to the Mekong River. Moreover, EDL-Gen has a relatively low debt-to-equity ratio, at 1.6, compared with other energy manufacturers, and thus can expect to refinance all debentures coming due in July 2021 by issuing new debentures. This clearly indicates EDL-Gen’s financial liquidity and promise to progress with this future investment plan.”

The funding success in 2021 testifies to EDL-Gen’s ability to stay on top among ASEAN clean electricity exporters, as is internationally recognised. This, in turn, helps to ensure fair electricity prices among GMS countries going forward, based on existing concession-based contracts. Above all, it places EDL-Gen in prime position to foster the importance of converting other consumable goods to renewable and more eco-friendly energy sources.

Duangsy Pharanhok Managing Director and CEO of EDL-Gen

To ensure this all comes to pass, EDL-Gen has therefore registered unsubordinated and unsecured bonds with a bondholder representative. The issue and issuer were rated BBB- with negative outlook by TRIS Rating on 4 June 2021.

More specifically, the EDL-Generation Public Company Bond Issuance No. 1/2564 Due B.E. 2567 (2024) comprises three-year tenor bonds with a fixed interest rate of 5.90% per annum, due in 2024. The bonds are offered to institutional and/or high-net worth investors during a tentative subscription period from 5-7 July 2021. Unit value is 1,000 baht with minimum subscription of 100 units.

The subscription is available through underwriters consisting of KTBST Securities Public Company Limited, Globlex Securities Company Limited, Finansia Syrus Securities Public Company Limited, Phillip Securities (Thailand) Public Company Limited, Merchant Partners Securities Public Company Limited, and AIRA Securities Public Company Limited.

Remark: Investments contain risks. Investors should carefully study the relevant information before making a decision to invest.