Recap: Global shares stayed near record highs on Friday as markets awaited US payroll figures that could shed light on Federal Reserve policy tightening. But China blue-chips fell nearly 3% to a four-month low, pushing down the MSCI emerging markets gauge by 1%.

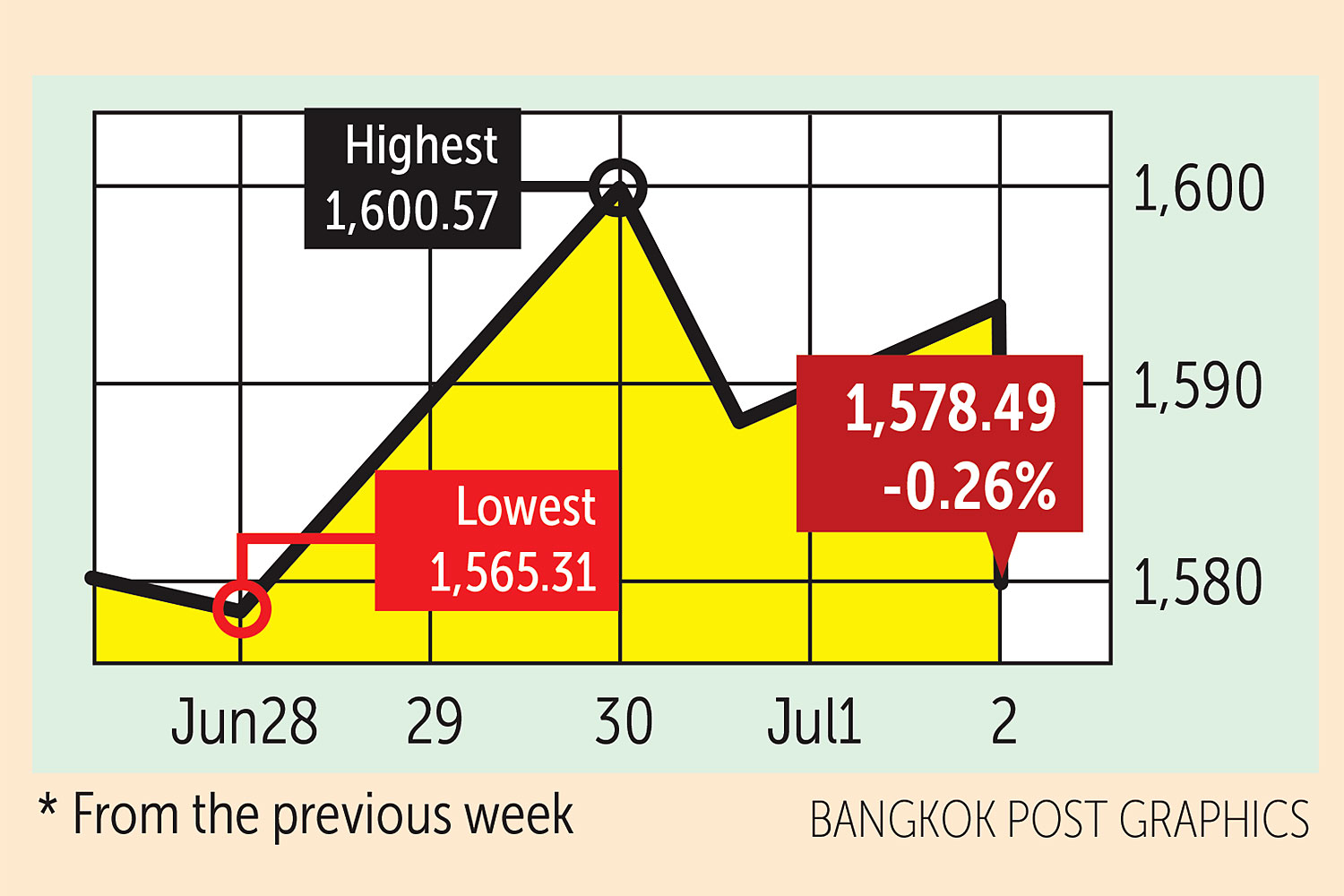

The SET index moved in a range of 1,565.31 and 1,600.57 points this week before closing yesterday at 1,578.49, down by 0.26% from the previous week, in daily turnover averaging 78.74 billion baht.

Retail investors were net buyers of 6.27 billion baht, institutional investors bought 2.28 billion and brokers bought 1.01 billion baht. Foreign investors sold a net 9.56 billion baht worth of shares.

Newsmakers: A total of 130 countries have agreed on a global tax reform ensuring that multinationals pay their fair share wherever they operate. The likes of Google, Amazon, Facebook and Apple would be taxed at a rate of at least 15% once the deal takes effect, the OECD said on Thursday.

- "Pandexit" is the new challenge for central banks and governments that opened the money taps wide to cushion the shock of Covid-19. Now they have to very carefully start turning them off, says the Bank for International Settlements.

- The Chinese ride-hailing leader Didi finished marginally above its $14 IPO price on its New York Stock Exchange debut on Wednesday, as Wall Street continues to embrace fast-growing tech companies regardless of their ability to turn a profit. Didi lost $1.6 billion last year.

- The number of Americans filing new claims for unemployment benefits fell more than expected last week, while layoffs plunged to a 21-year low in June as companies held on to their workers amid labour shortages.

- Britain's coronavirus-hit economy shrank by 1.6%, slightly more than expected, in the first quarter before a subsequent easing of lockdown restrictions, revised data showed on Wednesday.

- Singapore hopes to announce a further easing of Covid restrictions in mid-July as part of a strategy for reopening the economy that may also include the long-awaited return of leisure travel by the end of the year, Health Minister Ong Ye Kung said this week.

- A US judge on Monday dismissed the blockbuster antitrust action against Facebook filed last year by federal and state regulators, helping lift the value of the social media giant above $1 trillion for the first time.

- The Japanese auto giant Nissan on Thursday announced plans to build the UK's first car-battery "gigafactory", where it will build a new electric vehicle.

- Strong US demand boosted global sales of Toyota by 46% year-on-year in May, though production fell from pre-pandemic levels, hinting at a potential inventory crunch. Unit sales were up by one-third from a year earlier in Japan as well.

- The first three international flights carrying some 400 people -- some of them tourists but many of them Thai and foreign residents who had been away for over a year -- landed in Phuket on Thursday to kick off the much-hyped Phuket Sandbox tourism revival programme.

- Foreign arrivals could reach 3 million this year in a best-case scenario, say industry groups, who estimate the country lost 550,000 tourism jobs in the second quarter as the third Covid wave hit hard.

- The 30-day Covid lockdown of all construction sites and worker camps in Greater Bangkok will cost 140 billion baht and have a ripple effect across all supply chains in the construction and property sector, says the Thai Contractors Association.

- Factories are adopting stricter "bubble and seal" measures to control workers' movements and keep Covid at bay as authorities battle to keep the virus from spreading further.

- The Bank of Thailand is considering loosening foreign-exchange rules and red tape to curb volatility as the baht has hit a 13-month low around 32 to the US dollar.

- Thailand's policy rate is very low and liquidity in the banking system is ample and not impeding economic recovery, the central bank governor said.

- The government is preparing to allocate about 60 billion baht to support a fresh 50% co-payment subsidy for the monthly salaries of employees of small and medium-sized enterprises (SMEs), in a move to deter mass layoffs.

- The ratio of household debt to gross domestic product (GDP) rose to 90.5% in the first quarter, the highest since at least 2003, Bank of Thailand data showed.

- Thailand recorded a current account deficit of $2.6 billion in May, double the total in April, the Bank of Thailand said.

- Restaurants, coffee shops and bakery shops can now access loans from the Bank for Agriculture and Agricultural Cooperatives (BAAC) to combat the impact of the pandemic, said bank president Tanaratt Ngamvalairatt.

- The cabinet on Tuesday approved a proposal for seven state-owned financial institutions extending debt relief measures for their customers for another six months.

- The Board of Investment has approved enhanced incentives to research & development (R&D) and human resource development, to attract semiconductor manufacturing, digital activities and smart packaging businesses.

- The value of car exports from Thailand is expected to reach a record high this year, as a strong revival in shipments helps offset some of the damage done by the absence of tourism. Auto exports from January to May were worth $12.4 billion, more than half the full-year total of $21.4 billion in 2020.

- The government is accelerating talks with neighbouring countries to reopen 11 border checkpoints to boost cross-border trade, which has already shown signs of strong recovery.

- Sansiri Plc is partnering with XSpring Digital to accept cryptocurrencies as payments for housing at its projects.

- Thais lead the world in online shopping following a behavioural shift during the pandemic as people, says the marketing communications agency Wunderman Thompson. It found 94% of Thai consumers -- against a global average of 72% -- said online shopping had come to their rescue in 2020.

- Thai investors posted record net portfolio outflows of US$17.8 billion (570 billion baht) in the fourth quarter last year after the central bank relaxed offshore investment regulations. Average outflows were only $3.1 billion a year between 2010 and 2019.

- The number of smartphone users who will adopt 5G in Thailand is expected to exceed 5 million by the end of this year, says the Swedish hardware supplier Ericsson. Thailand is also in the top 10 in the world in terms of the rise in 5G subscriptions, it said.

- The SET-listed property and retail developer Central Pattana (CPN) will spend 400 million baht to spur spending at its malls in the second half of this year. Tenants to use Central's online platforms as a potential source of additional sales income.

Coming up: Thailand will release June consumer confidence and inflation data on Monday, Australia will release May retail sales, and China and Germany will release composite PMI data.

Australia's central bank will announce its policy rate decision on Tuesday, Germany and the euro zone will release July economic sentiment, and the US will release June non-manufacturing PMI.

The US will release May job opening figures on Wednesday. Germany will release May trade data on Thursday and Canada will release June employment figures on Friday.

Stocks to watch: Tisco Securities sees positive sentiment for stocks related to electric vehicles in light of government pledges of support for EV development. Possible beneficiaries include EA, NEX, GPSC, PTT, BANPU and BCPG. Investors interested in a city reopening theme might see momentum from BAM, BDMS, BJC, BTS, CPALL, HMPRO and WHA.

The brokerage also recommends construction stocks with prospects for second-half growth, notably CK and STEC, as bidding for more state projects open this month. Among export plays, Tisco recommends CPF, TU, KCE, JWD and SCGP. Those expecting big things from hemp could look at DOD, RBF, KWM and GUNKUL.

SCB Securities recommends defensive and high-dividend yield stocks such as GPSC and BGRIM, along with EV and semiconductor stocks such as KCE, HANA and EA. Healthcare stocks expected to benefit from the pandemic are BDMS and RJH. Promising mid- to small-cap stocks are CPW, PM, SFT, TPAC and WICE.

Technical view: DBS Vickers Securities sees support at 1,550 points and resistance at 1,620. Capital Nomura Securities sees support at 1,529 and resistance at 1,643.