Exports seem to be the only driver to shore up the fragile Thai economy this year, ravaged by Covid-19 outbreaks.

Yet a lingering container shortage and steep freight costs are threatening Thai shipment growth prospects, in addition to a dearth of migrant workers.

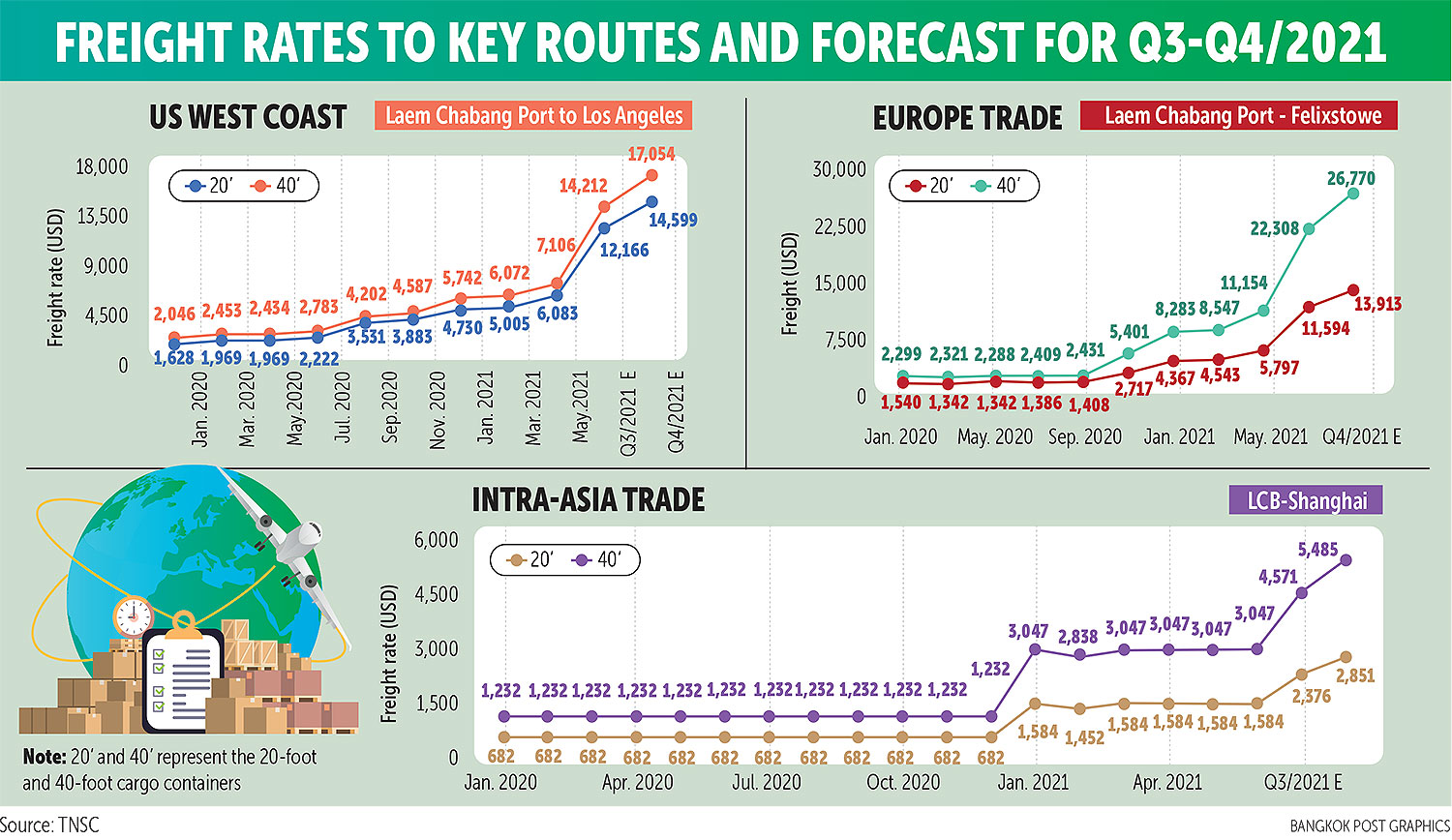

Freight costs in Thailand have been rising since October 2020 and reached a peak in February and March this year after China, the world's biggest exporter, ramped up its shipments to the US and Europe, which are also key export markets for Thailand.

The most expensive freight rate was the route from Bangkok to the US, with prices rising 400% to about US$10,000 (328,640 baht) per container during the two months from $2,000 in the same period last year.

With Thai exporters in desperate need of containers and shipping space for outbound shipments to the US and Europe, Chaichan Chareonsuk, president of the Thai National Shippers' Council (TNSC), spoke on behalf of the Asian Shippers' Alliance (ASA) regarding these issues to a symposium of the UN Conference on Trade and Development on July 13.

He said rising freight rates and logistics constraints affect all countries and need to be tackled rapidly to prevent more damage to international trade.

According to Mr Chaichan, US President Joe Biden is aware of the hefty shipping costs and directed the Federal Maritime Commission to crack down on "unjust and unreasonable fees" in the ocean shipping industry.

The commission is working closely with the US Justice Department to investigate anti-competitive practices.

Several causes

Mr Chaichan said the main obstacle is Covid-19 outbreaks and lockdown measures that have resulted in a significant decrease in labour and port efficiency in many countries.

Temporary closures of businesses and factories, the recovery of Chinese exports, and rising demand in the US and EU are additional factors, he said.

Other snafus such as the Suez Canal blockage in March and bottlenecks at gateways in Southern California and Yantian port in China tied up ships at sea for days or weeks at a time, leading to higher freight costs.

Mr Chaichan said limited container production has caused port congestion, longer port-to-port transit times and shipment delays, resulting in slower container turnover around the world.

The longer wait times for loading goods on vessels at ports that are centres of movement also resulted in a risk of raw material shortages in global value chains, he said.

Moreover, the longer transit times resulted in delayed payments for certain trade terms, causing cash flow problems for exporters.

The delay in shipping schedules then leads to a shortage of containers and management problems related to logistics. This cycle is causing a conflict among domestic stakeholders such as shippers, ship agents, port operators, truck companies and container yards, said Mr Chaichan.

Warehousing and inventory costs have risen because of a large stock of finished goods as exporters, though they have higher costs, cannot raise their prices as consumer purchasing power has not yet recovered, he said.

"The TNSC has teamed up with ASA to bring these problems to the attention of international communities in order to expedite tackling them, particularly higher logistics costs and local charges," Mr Chaichan said.

Thailand may have to bear higher freight rates as demand for shipping space is outpacing supply as the world's exports are recovering, he said.

"We expect the freight rate to stay relatively high in the third and fourth quarters," said Mr Chaichan.

Slight impact

Despite the high freight rate, Mr Chaichan said Thai exporters are likely to ride out the freight cost concerns, as indicated by the healthy export growth over the last few months.

"Most Thai exporters are selling products with prices at the port in mind so they don't bear the brunt of freight costs," he said.

"It is importers who are mostly being held responsible for the freight and transport costs. There are only 30%-40% of exports in which Thai exporters have to deal with the freight costs."

However, food, crops such as rice and tapioca, textiles, auto parts and rubber products are being affected by expensive freight costs because the value of these items is relatively cheap, but they are heavy, said Mr Chaichan.

He said the best solution for Thai exporters is to book advanced shipping space, which will help reduce risks in the year to come.

Despite a spate of challenges, TNSC forecasts export expansion by 10% this year if the government can control Covid-19 infections over the next two months.

However, if high levels of infections persist, the council expects growth of only 7% this year.

"Although domestic outbreaks remain severe, leading some factories to temporarily halt production and postpone the delivery of goods to destination countries, we expect total exports will not be affected much in the short term," Mr Chaichan said.

"Exporters have managed to deliver their purchase orders for the peak period in the third quarter."

For the first half this year, Thai exports expanded by 15.5% to $132 billion, while imports rose by 26.2% to $130 billion, resulting in a trade surplus of $2.44 billion.

Freight rate downplayed

Kriengkrai Thiennukul, a vice-chairman of the Federation of Thai Industries (FTI), said despite the high freight rate, the FTI believes it will not severely affect Thai exporters.

Manufacturers should continue to benefit from the global economic recovery, which is driving demand for goods in the world market, he said.

FTI chairman Supant Mongkolsuthree said other factors like the baht depreciation are also a boon for Thai export prospects.

Mr Kriengkrai said a weaker baht should help cushion the impact of freight rates.

"If the value of the baht continues to decrease, export value will increase, helping exporters," he said.

According to Mr Supant, the greater worry is rising Covid-19 infections in industrial factories.

"This is a serious factor that will affect the manufacturing sector and may cause a setback to Thai exports," he said.