The Finance Ministry's plan to impose a tax on share sales will decrease the Thai bourse's competitiveness because it subjects investors to higher costs, says Pakorn Peetathawatchai, president of the Stock Exchange of Thailand (SET).

The Finance Ministry announced on Wednesday it plans to impose a 0.1% tax on securities trades by entities whose monthly trading volume exceeds 1 million baht next year. The market reacted negatively on Friday to the news, declining 3.59 points or -0.22% to close at 1,641.73 points in trade worth 96.5 billion baht.

The negative effect was contained because several foreign funds and investors already adjusted their portfolios as the market is entering the long year-end holiday period.

Mr Pakorn said the new levy would increase the cost burden for investors, with foreign short-term speculative funds that use high-frequency trading likely to suffer the most from this change. These funds account for 20-30% of the market's average daily trading value, he said.

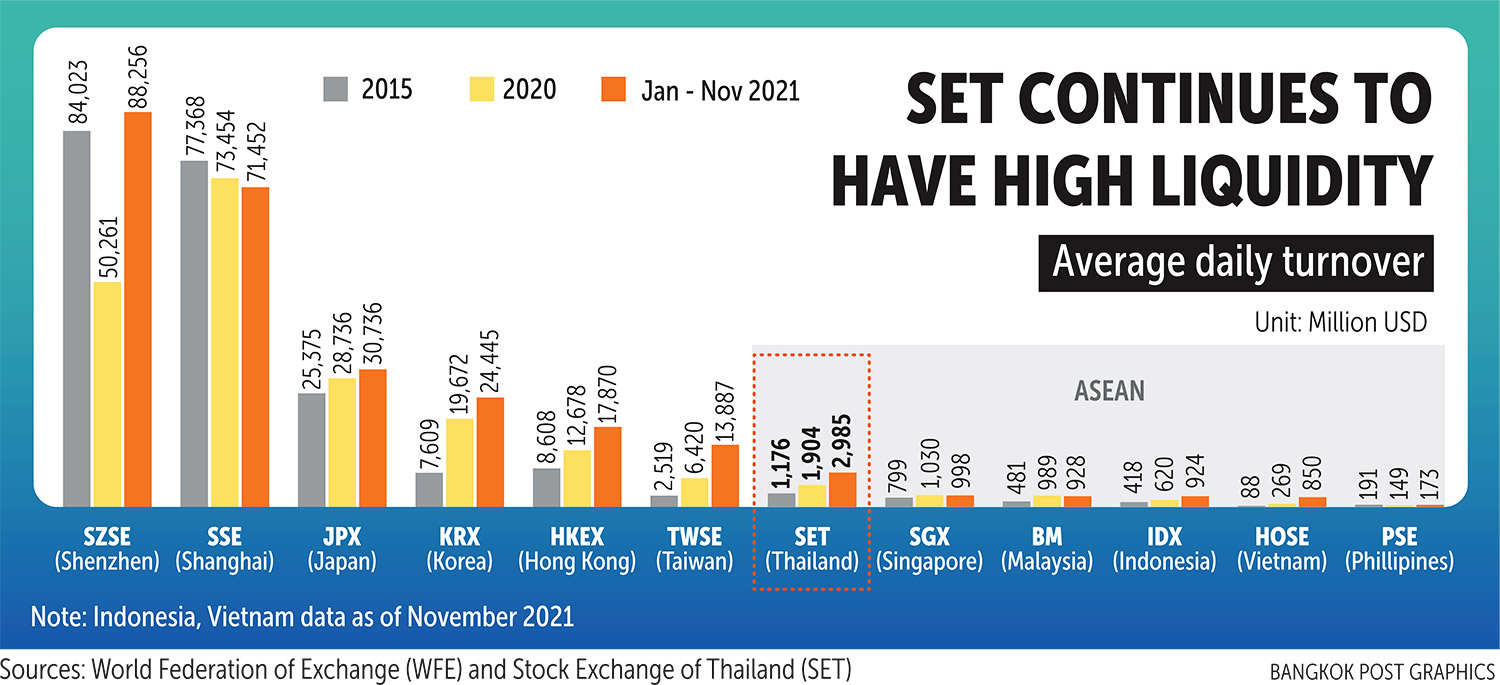

The SET has been a regional champion in terms of liquidity for seven consecutive years, said Mr Pakorn. The bourse's year-to-date average turnover stands at around 90 billion baht.

"The issue of tax collection is not unique to Thailand. Recently, Indonesia and Malaysia also considered this issue because they wanted more tax revenue to stimulate the economy after the pandemic," he said.

Stock markets in Indonesia, Taiwan, Vietnam and South Korea also collect transaction taxes, while those in Hong Kong, Singapore and Malaysia collect a stamp duty, said Mr Pakorn.

The SET submitted information to the Finance Ministry to consider such a tax policy's possible quantitative effects on the Thai stock market, claiming it would lessen the market's competitiveness globally.

The SET recommends the ministry give investors some time to prepare for any new tax, he said.

The bourse should not see much of a sell-off in the short term because it is the year-end period, said Mr Pakorn.

Therdsak Thaveeteeratham, executive vice-president of Asia Plus Securities, said based on past SET average trading value, the ministry would fetch more than 10 billion baht from a share sales tax per year if the policy is implemented.

However, a transaction tax would reduce the Thai market's competitiveness globally, with both Thai and foreign investors likely to move to other bourses with lower costs, causing the SET's market turnover to shrink, he said.

Niwet Hemwachirawarakorn, a well-known value investor, said it is not the right time to collect such a tax because the Thai economy has not recovered from the pandemic.