A trade surplus and a surge in oil prices drove the Stock Exchange of Thailand index, while Bangkok Dusit Medical Services Plc (BDMS) and Bangkok Airways Plc (BA) shares plunged on Monday after the resignation of billionaire founder Prasert Prasarttong-Osoth.

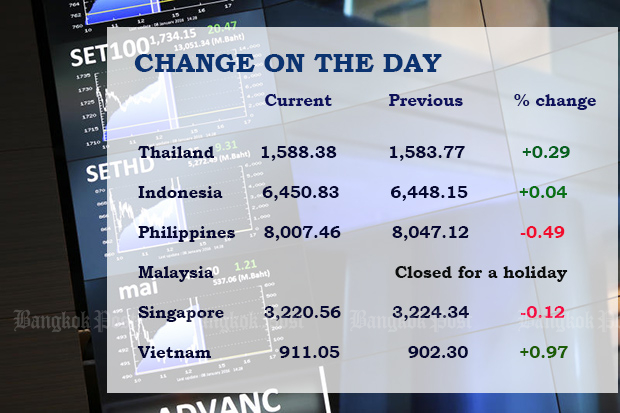

The SET index rose 4.61 points or 0.29% to 1,588.38, in turnover of 45 billion baht, after data showed higher exports for 2018 and due to a surge in oil prices.

While customs-cleared exports unexpectedly dropped in December, an 8.15% decline in imports resulted in a trade surplus of $1.06 billion, compared to expectations of $1.1 billion deficit.

Meanwhile, crude prices rose to their highest in 2019 after data showed refinery processing in China climbed to a record last year despite a slowing economy.

Energy stocks PTT Plc and PTT Exploration and Production Plc were among the top boosts. PTT rose 50 satang or 1.04% to 48.75 baht and PTTEP gained 2 baht or 1.60% to 127 baht.

Shares of BDMS plunged 2 baht or 8.47% to 21.60 baht, while BA slid 90 satang or 7.14% to 11.70 baht, after Dr Prasert resigned as chief executive officer of BDMS and BA.

The move came after the Securities and Exchange Commission on Friday accused Dr Prasert, his daughter Poramaporn Prasarttong-Osoth and Narumon Chainaknan of BA stock manipulation.

Ms Poramaporn, chief operating officer at BDMS, and Ms Narumon, executive secretary to the CEO of BA, also resigned from their positions on Monday.

Other Southeast Asian stock markets ended mixed on expectations of further stimulus from China after data showed the slowest rate of annual economic growth in 28 years, while positive remarks regarding US-China trade relations boosted investor sentiment.

China's economic growth cooled slightly to 6.4% in the fourth quarter from a year earlier, weighed down by weak investment, faltering consumer confidence and the trade war with the United States, leaving 2018 growth at 6.6%, the weakest since 1990.

Chinese policymakers have pledged more support to the economy this year with the government expected to unveil more fiscal stimulus measures during the annual parliament meeting in March.

"Markets had expected the slowing economic growth, I think focus is shifted to stimulus measures that China has announced over the past few weeks," said Joel Ng, an analyst with KGI Securities.

Meanwhile, US President Donald Trump said on Saturday there had been progress toward a trade deal with China, but denied that he was considering lifting tariffs.

Broader Asian markets edged higher with MSCI's broadest index of Asia-Pacific shares outside Japan up 0.2%.

Vietnam stocks led gains in Southeast Asia with a rise of 1%. Financial and real estate stocks were among the top contributors with both CMC Corp and Ninh Van Bay Travel Real Estate JSC rising 7%.

Singapore stocks closed marginally lower ahead of December inflation data expected on Wednesday.

The city-state's consumer price index probably rose 0.4% last month from a year earlier, according to a Reuters poll.

Philippine shares snapped two straight sessions of gains as investors booked profits after the benchmark stock index posted a nine-and-a-half-month closing high on Friday.

Malaysian markets were closed for a holiday.