When you give something away free, people are probably going to want more of it.

That is the experience so far for online brokers following the industrywide move to zero-commission trading in October. Investors initially punished the companies for vaporizing a big chunk of their revenue but wised up when they began to consider the bigger picture. More people trading means more cheap cash that can generate other revenue, plus bigger opportunities to sell services like wealth management or automated portfolio tools.

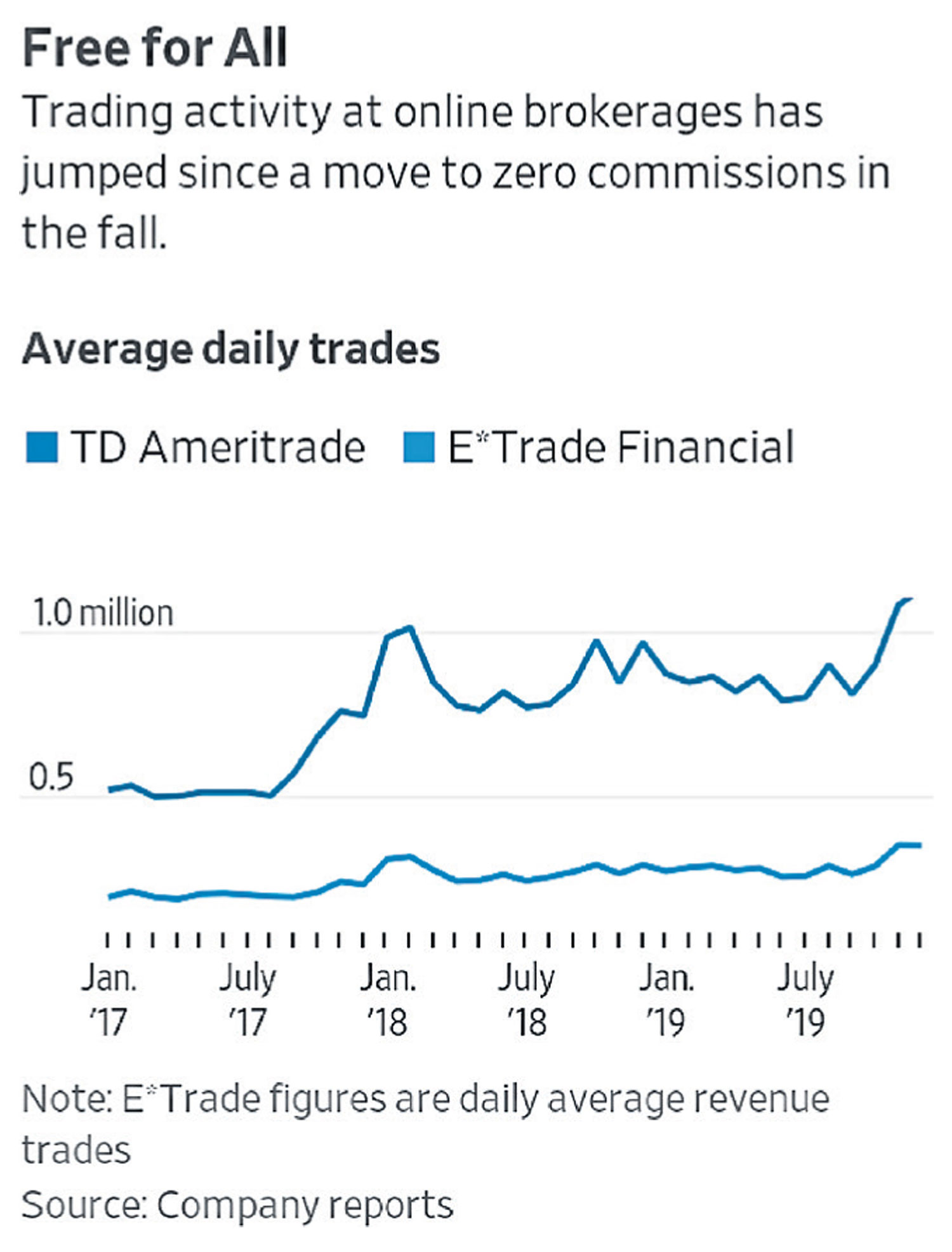

The optimist's case was borne out in the last three months of the year at TD Ameritrade Holding. Clients traded more than a million times a day on average in the quarter for the first time. Total trades jumped 13% from the prior year, even though the quarter was far less volatile. Interestingly, the growth may have been in smaller trades, judging by the 14% sequential decline in the typical order-flow payment Ameritrade received, noted Rich Repetto, an analyst at Piper Sandler. The trend looks like it is holding into 2020, too: January's average daily trade count is tracking at 1.4 million so far, Ameritrade said.

The same trend held at E*Trade Financial. Daily average revenue trades made by customers in the quarter topped 330,000, a company record and a jump of 16% from a year ago.

It shouldn't be a surprise that knocking back costs has boosted volume. The relationship between commission and trading has been a driving force on Wall Street for decades. Through the 1960s, turnover of stocks listed on the New York Stock Exchange was much lower than it is today. It wasn't unusual for the average annual holding time to be six years.

The abolishment of fixed commissions in 1975 sped up turnover dramatically. By the 1980s, average annual holding times were around two years, according to figures compiled by investment manager MFS. In 2018, it was around nine months. Other trends have intervened, like the rise of high-speed market-making. Individual investors in general make up a smaller share of the market now than they did in decades past, but all trading has been encouraged by lower explicit trading costs.

Over at Charles Schwab, the first mover in zero-commissions, there wasn't a quarterly jump over the year-ago period. But the fact that total average daily trades in the quarter were down just 9% from a year ago is solid--the fourth quarter of 2018 had been up 38%. Schwab did see a record fourth-quarter influx of core new assets and a 14% increase in new brokerage accounts. A rise in asset management and administration fees also helped overall revenue to drop just 2%, even as trading revenue fell off by 58%.

The benefits are flowing elsewhere too. BlackRock's exchange-traded funds are popular with individual investors and independent advisers. Chief Executive Larry Fink told analysts in mid-January that "our monthly flows accelerated across these platforms since the move to commission-free trading," and that he anticipated seeing the "benefit of these moves [playing] out in the coming months and years."

So far, the laws of supply and demand are playing out with a vengeance.