Opening of new cryptocurrency accounts may slow in the second half of this year as the Anti-Money Laundering Office (Amlo) announced local digital exchanges must verify their customers' identities through a "dip-chip" machine that requires clients to be physically present.

The dip-chip requirement comes into effect in September, said Poramin Insom, co-founder and director of Satang Corp.

As of April 26, there were 697,780 cryptocurrency accounts nationwide, a surge from 160,000 at the end of last year.

"Most digital asset exchanges are still busy preparing their systems to accommodate the growing number of clients as new account applications continue to flow in. However, this growth may be curbed if the application process becomes more complicated," said Mr Poramin.

Digital asset intermediaries plan to discuss the issue at a forum held by the Thailand Digital Asset Operators Trade Association, a self-regulated organisation, to gather questions for further discussion with government entities such as the Securities and Exchange Commission (SEC) and Amlo.

Every step in the digital account opening process is currently done electronically, starting from submitting the application form to verifying a customer's identity and account approval.

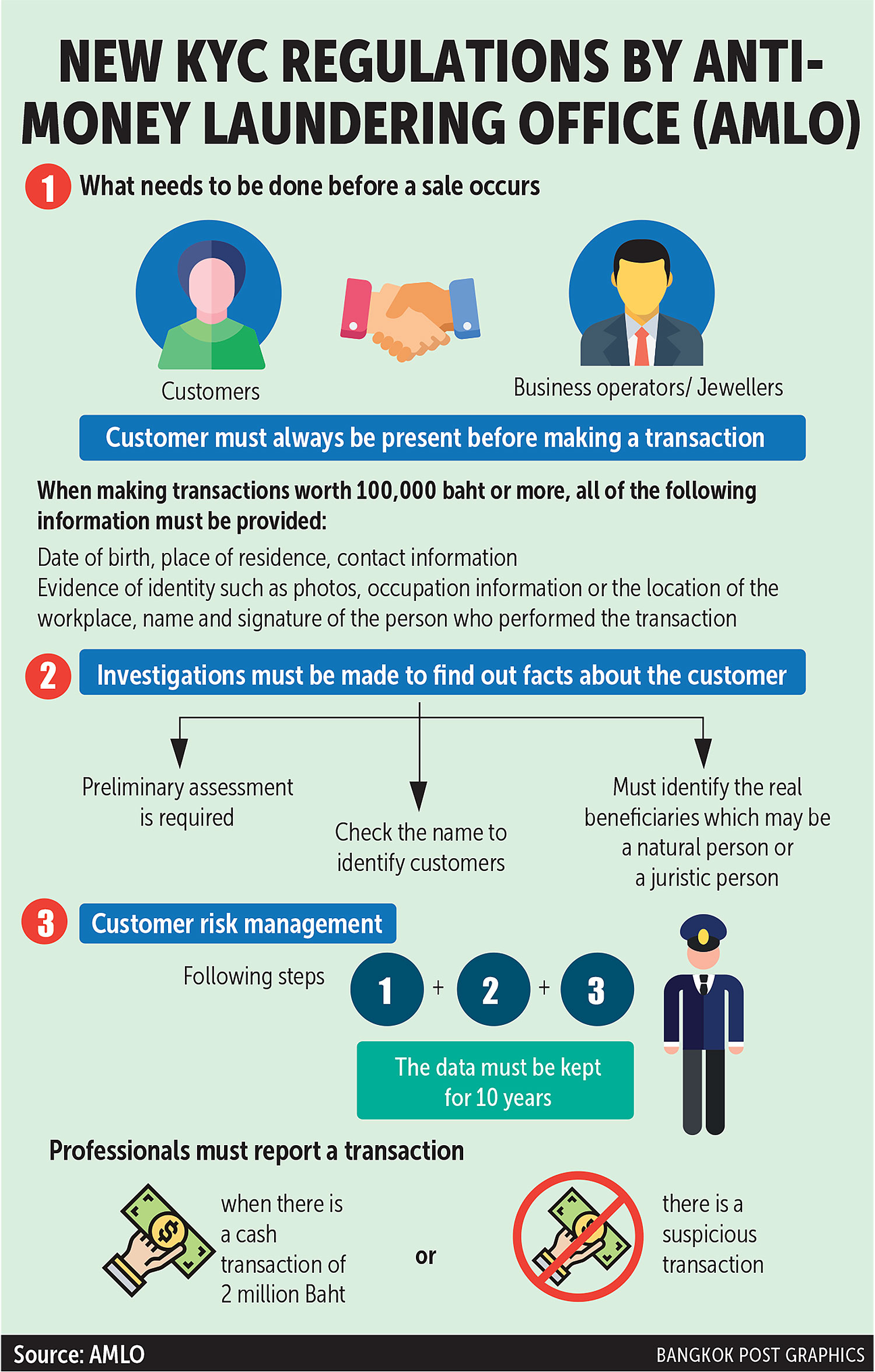

However, the exchanges still need time to approve an account because they must recheck and determine if documents submitted by customers comply with the SEC's regulations for the know-your-customer (KYC) process and suitability test.

An applicant's documents must be rechecked by relevant government agencies and if officials find a customer has submitted fake documents or is residing in a country where cryptocurrency trading is banned, the application will be rejected.

Mr Poramin said digital asset exchanges have a duty to report any transaction worth over 1.8 million baht under the money laundering law, and must set up a database for inspections by regulators.

The Anti-Money Laundering Act came into force in 1999 and requires financial institutions, entities operating financial-related businesses, and legal professionals such as investment advisers and real estate brokerages to report any transaction meeting its requirements, and preserve documentation and data pertaining to transactions as evidence for 5-10 years.

In addition, around 6,000 gold shops nationwide are required to ask their customers to show their ID cards when purchasing or selling gold worth over 100,000 baht in cash.

Thanarat Pasawongse, chief executive of Hua Seng Heng, said most large gold shops have been using ID card dip-chip machines for identity verification for 4-5 years because it is more convenient than photocopying.

Data collected from a dip-chip machine can also be used in customer relationship management. For example, when a customer makes a transaction online, they can directly update their personal information on their mobile device or computer.

"However, some customers still prefer to maintain their privacy," said Mr Thanarat.

He said large gold shops have a higher chance of being randomly checked by regulators, so they need to prepare a verification method that is more stringent than required from regulators to be safe.

"I understand the intention of officials, but we have difficulty complying with the current criteria," said Mr Thanarat. "Gold prices have been constantly increasing and just four baht of gold nowadays is worth 100,000 baht. I hope the minimum trigger point will not be reduced."

Cash transactions worth over 100,000 baht also require customers to show their ID cards, while transactions worth over 2 million require business operators to file a report with Amlo. For "suspicious" transactions, the operators file a report without informing the customer.

Jitti Tangsitpakdee, president of the Gold Traders Association, said the association is expediting the training of gold shops in Thailand to prevent accidents, as they are now legally obligated to perform risk assessment, case management and customer screening.