Citigold is a wealth management service for clients with total deposits or investments of 5 million baht and above with Citibank Thailand. Citigold offers end-to-end premier banking solutions, including advisory and wealth management services, backed by a dedicated Relationship Manager and team of experts trained by the Citi l Wharton Global Wealth Institute. Citigold also provides in-depth investment and economic insights to help investors make investment decisions. Citigold customers enjoy an array of exclusive, curated lifestyle and banking privileges. One of Citigold’s product offering is the Franklin Floating Rate mutual fund, featured in this article.

Yields on US Treasuries with five year or more duration touched its seven-year record high at above 3.0%. The U.S. Federal Reserve has hiked interest rates three times this year – in March, June and September. Citi analysts expect Treasury yields to reach 3.75% in 2019, which may rise further if growth endures and the Fed tightens in line with forecasts. In addition, at current levels, the yields on 10-year US treasuries are high compared to other developed markets. What challenge and opportunity can this rising rate environment present to investors?

A rising interest rate environment can be challenging for investors who invest in traditional fixed coupon bonds which make periodic fixed interest payments and return principal at maturity. Investors are exposed to duration risk where rising rates generally leads to falling bond prices.

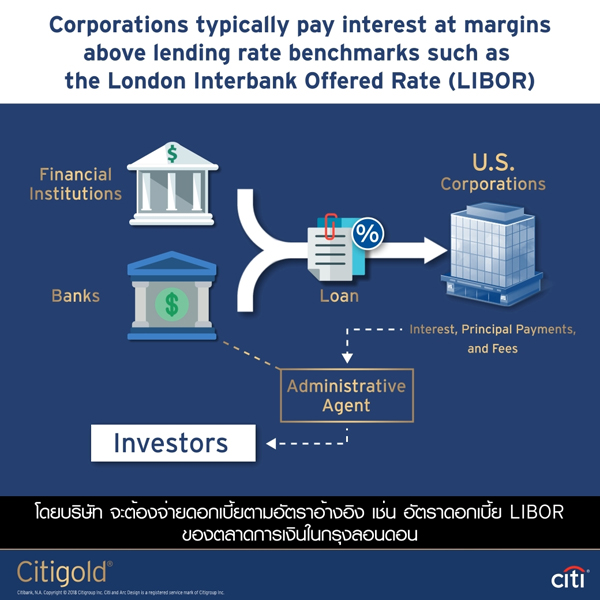

Floating rate bank loans on the other hand exhibit much less price sensitivity to changes in interest rates compared to fixed coupon bonds - they carry almost no duration risk. Floating rate bank loans are loans made by banks and financial institutions to corporations to fund a variety of transactions, such as capital restructuring, acquisitions, and leveraged buyouts. The cost of borrowing for these corporations are typically set at fixed margins above short term lending rates such as the US 3-Month LIBOR. Borrowing costs are reset periodically (typically quarterly) to reflect any changes in short term rates. In a rising rate environment, bank loan investors should expect to receive higher levels of income as the cost of borrowing to corporations increases.

The regularly resetting coupon rate gives floating-rate loans an extremely short duration, which is usually no longer than the time between reset dates. Despite the short duration of floating-rate loans, their yields tend to be relatively high due to their higher credit risk. This floating feature makes loan prices less sensitive to shifts in interest rates. A common tactic is to invest in bonds with shorter time horizons to make a fixed-income portfolio less sensitive to interest rate changes.

Amidst this rising rate environment, Citi analysts are more positive on bonds. To take advantage of this growing opportunity created by higher US interest rates, Citi analysts have added to overweight recommendations of short-term US Treasuries, corporate debt, and municipals.

The Franklin Floating Rate mutual fund invests primarily in senior secured, floating rate corporate loans allowing investors to leverage this rising interest rate environment. This mutual fund is exclusively offered in US Dollar currency in Thailand, only by Citigold, the only global wealth advisor in Thailand that lets you invest directly in up to 180 mutual funds from 16 leading onshore and offshore fund managers.

Invest with Franklin Templeton Investments, an international fund management company, through Citigold.

To speak with a Citigold relationship manager about these investment products, please call 02-081-0999 or visit https://citi.asia/THdCGfNS for more information.

Disclaimer:

(1) Investments contain certain risk; please study the prospectus and all relevant materials before investing. Investment products are not offered to US persons.

(2) Foreign Exchange Risk: Investors investing in investment products denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal when foreign currency is converted back to the investors’ home currency. Exchange controls may be applicable from time to time to certain foreign currencies. Investors should therefore determine whether any foreign currency investment in suitable for them in the light of their personal investment objectives, financial means, and risk profile.

Citibank, N.A. Copyright © Citigroup Inc. Citi and Arc Design is a registered service mark of Citigroup Inc.