Recap: Global bourses struggled yesterday after the US Federal Reserve introduced the new policy framework, with Japanese equities shedding gains following the surprise resignation of Prime Minister Shinzo Abe.

The SET index moved in a range of 1,299.05 and 1,337.61 points before closing at 1,323.31, up 1.8% from the previous week, in daily turnover averaging 53.79 billion baht.

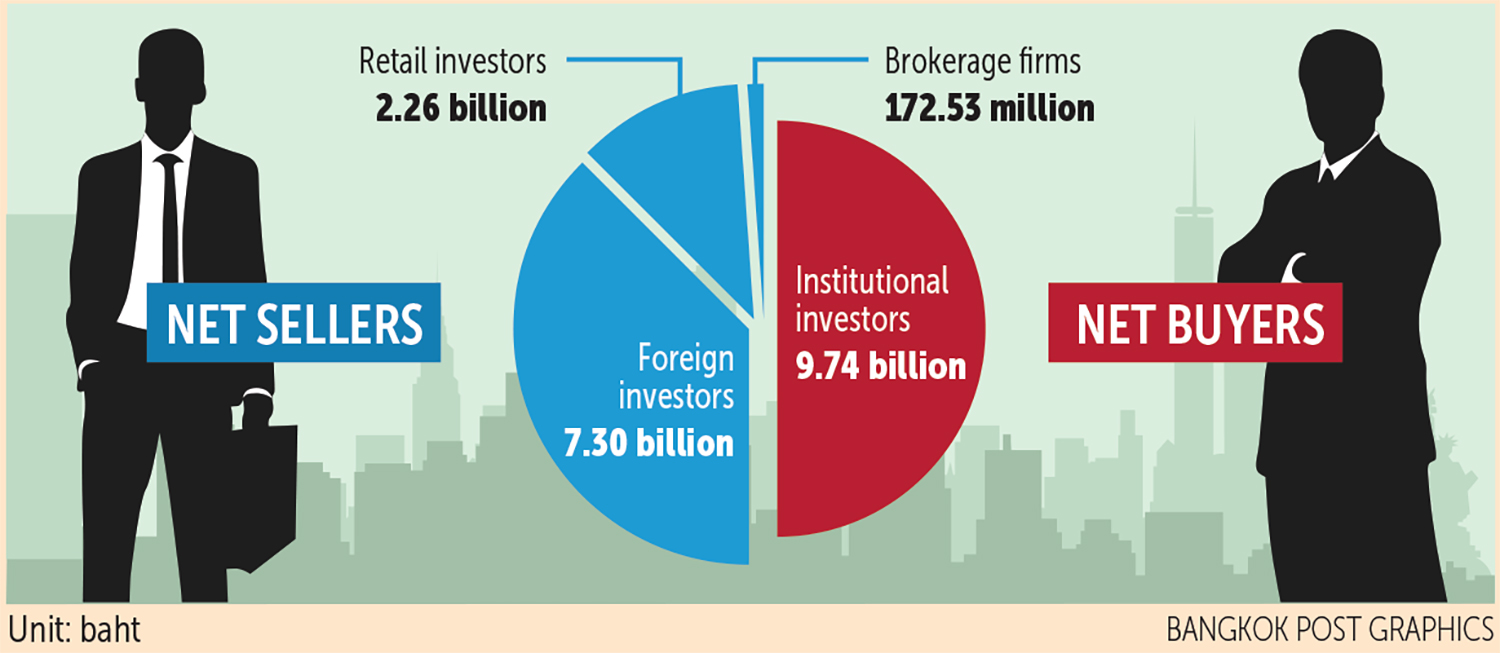

Institutional investors were net buyers of 9.74 billion baht. Foreign investors were net sellers of 7.3 billion, retail investors sold 2.26 billion and brokerage firms offloaded 172.53 million baht worth of shares.

Newsmakers: Japanese Prime Minister Shinzo Abe yesterday surprised the nation by announcing plans to resign because of health problems, ending a record-setting tenure with no clear successor yet in place.

- Donald Trump tore into challenger Joe Biden as a threat to the "American Dream" in a bruising speech accepting the Republican nomination for a second US presidential term against a backdrop of racial tensions and the deadly coronavirus pandemic.

- South Korean authorities have reimposed restrictions in Seoul after a 15th straight day of triple-digit increases in Covid-19 cases. Gyms and other indoor sports facilities have been ordered closed, and coffee shops will only be allowed to serve takeout.

- Top Chinese and US negotiators have agreed to "push forward" their phase one economic deal, amid increasing tension between the two sides on several fronts, as China fired a barrage of medium-range missiles in the South China Sea.

- Gold prices climbed yesterday as investors weighed the impact of the US Federal Reserve's new approach to setting monetary policy, with a more relaxed stance on inflation. Chairman Jerome Powell said the Fed would seek inflation that averages 2% over time, a step that implies allowing for price gains to overshoot.

- Ministers from 15 Asia Pacific countries negotiating the regional Comprehensive Economic Partnership said on Thursday they have made "significant progress" toward the signing of the deal in November. India has opted out of the China-led pact but members say it is welcome to return at any time.

- Taiwan's government has yielded on a long-standing obstacle to a free-trade agreement with the US by lifting restrictions on American pork and beef. But President Tsai Ing-wen said the two sides still had more work to do.

- American authorities announced an emergency authorisation for doctors to use blood plasma from recovered coronavirus patients as a treatment against the disease that has killed over 180,000 in the US.

- Foreign tourists won't be allowed to visit Bali for the rest of 2020 due to coronavirus concerns, its governor said, scrapping a plan to open up the Indonesian island from next month.

- Israel's landmark deal with the UAE to normalise ties could see businesses from the Jewish state operating on arch-rival Iran's doorstep, but are unlikely to disturb Emirati economic ties to Iran.

- Shares in the Chinese e-commerce giant Alibaba jumped to a new record Wednesday morning, a day after the group's financial arm filed paperwork for a joint Shanghai and Hong Kong listing.

- TikTok on Monday filed a lawsuit challenging the US government's crackdown on the popular Chinese-owned video app, which Washington accuses of being a security threat. TikTok CEO Kevin Mayer subsequently quit the company as tensions soar between Washington and Beijing over the video platform.

- The Australian flag carrier Qantas announced plans Tuesday to cut almost 2,500 more jobs, just days after posting a huge annual loss as it reels from a collapse in demand caused by the coronavirus.

- Tourist arrivals and spending in Thailand slid about 70% in the first seven months of this year, as a fourth month of border closures aimed at keeping out Covid-19 took a bite out of the economy.

- Exports showed signs of recovery, with July's figures registering a smaller drop of 11.4% year-on-year after a 23.2% fall in June.

- The manufacturing production index declined by a bigger-than-expected 14.7% in July from a year earlier, led by lower production of cars and petroleum amid the coronavirus outbreak, the Industry Ministry said.

- The resumption of foreign tourism is necessary for the sake of the local economy, but disease control measures will be strict, says Prime Minister Gen Prayut Chan-o-cha.

- The tourism industry is expected to witness more consolidation as the pandemic impact lasts until the third quarter next year, say operators, while Thailand needs to rebrand itself to tap into the quality market by targeting the health and wellness segment.

- The Industry Ministry will stimulate domestic car sales by working with the Finance Ministry to offer trade-in coupons, worth 100,000 baht each, for individual car owners who can also use their expense to reduce tax.

- Revenue collection for fiscal 2021 warrants concern because of the pass-through effect from this year's economic slowdown, says the Revenue Department.

- Kerry Express Thailand, the country's leading parcel delivery provider, has submitted an initial public offering filing to the Securities and Exchange Commission in preparation to offer up to 300 million IPO shares to the public.

- The Central Bankruptcy Court has set Sept 14 for a decision on whether Thai Airways International should enter rehabilitation.

- Mitsubishi Motors Thailand says it remains committed to a 20-billion-baht investment in the country next year, as the Japanese automaker stressed it will not retreat from Thailand, rather shifting gears for global electric vehicle exports.

- SET-listed Energy Absolute (EA) aims to be the first country in Asean to operate a battery business by co-launching a new study on lithium-ion battery recycling for electric vehicles with Chulalongkorn University engineers.

- B.Grimm Power Plc, Thailand's top private power generation firm by capacity, continues to expand its domain in renewable energy and liquefied natural gas businesses as cleaner energy is becoming a new global trend.

Coming up: China will release August manufacturing PMI on Monday, Japan will announce August consumer confidence, and Turkey and Italy will release Q2 GDP data. On the same day, Thailand will announce July current account data, private consumption, private investment and June retail sales.

Brazil will announce Q2 GDP and the Reserve Bank of Australia will announce its interest rate decision on Tuesday. On the same day, Thailand will announce August manufacturing PMI, business confidence and inflation data.

Australia will announce Q2 GDP data on Wednesday. Australia, Canada and the US will release July trade figures on Thursday, with Thailand releasing August consumer confidence. The US will release August non-farm payrolls on Friday.

Stocks to watch: UOB Kay Hian Securities Thailand suggests a 60:40 ratio of cash to securities at the moment. It recommends accumulating infrastructure funds such as DIF, JASIF, SUPEREIF and BTSGIF, and shares of firms expected to post big profit growth this year, such as CKP and TASCO.

Capital Nomura Securities recommends speculative buysof stocks expected to be included in the revised FTSE All-World index on Sept 18. Suggested picks are CRC, BBL and BCG, along with MEGA and JMT for the FTSE SmallCap index. Firms expected to have a positive outlook for the third quarter are TU, CPF, TASCO, ICHI, HTC, JMT, WICE, BEM, SMT, KCE and HANA.

Technical view: DBS Vickers Securities Thailand sees support at 1,280 points and resistance at 1,350. UOB Kay Hian sees support at 1,296 and resistance at 1,355.