Recap: Global shares fell for the fifth straight day yesterday as investors fretted about the spread of the Delta coronavirus variant, slowing Chinese growth and the timing of Federal Reserve stimulus reduction. The US dollar continued to rise as a safe haven after hitting nine-month high on Thursday.

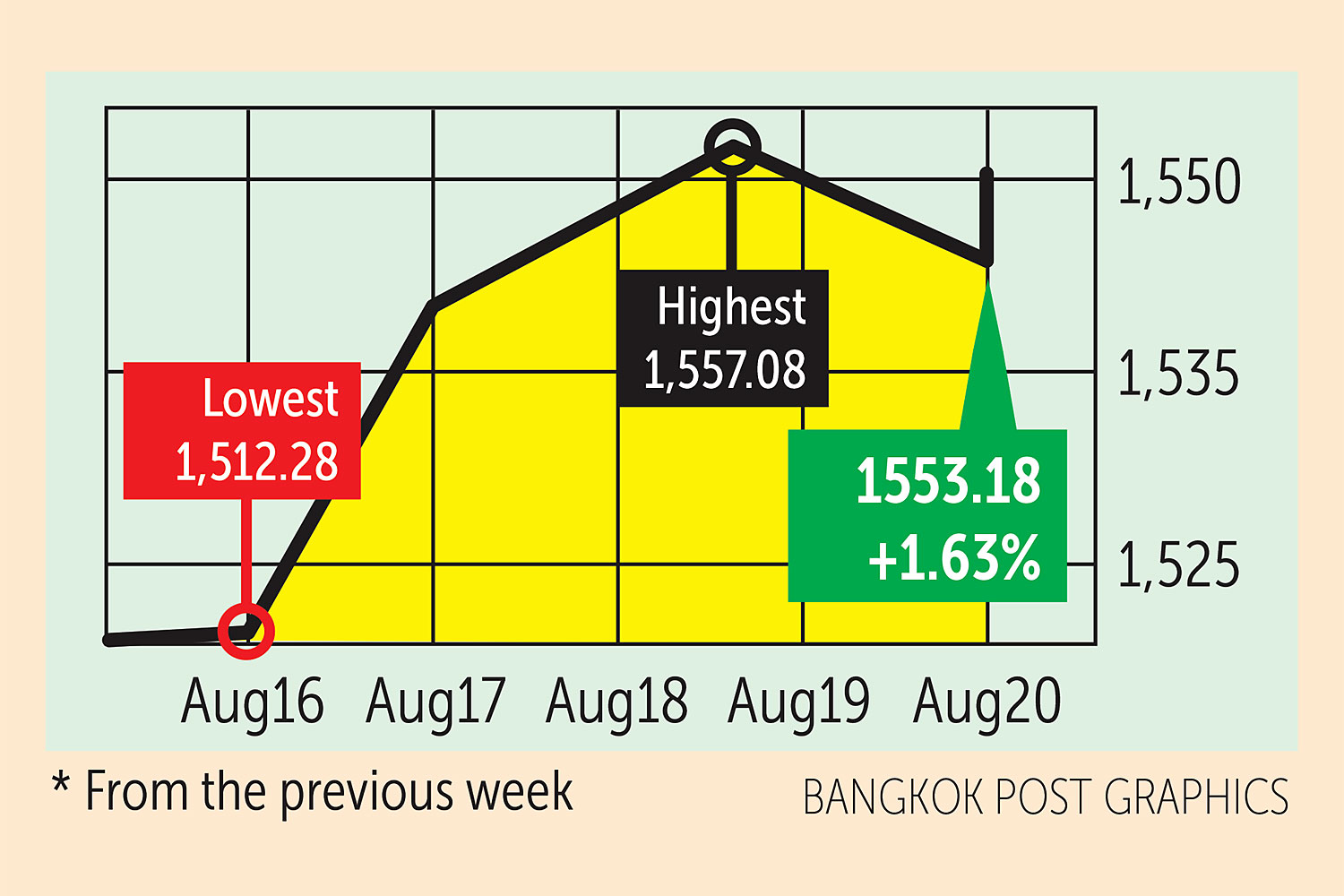

The SET index moved in a range of 1,512.28 and 1,557.08 points this week before closing yesterday at 1,553.18 points, up 1.63% from the previous week, in daily turnover averaging 80.55 billion baht.

Institutional investors were net buyers of 3.83 billion baht. Foreign investors were net sellers of 2.56 billion baht, brokerage firms sold 1.24 billion and retail investors offloaded 23.13 million baht worth of shares.

Newsmakers: Global markets went into a tailspin on Thursday after minutes of the Federal Reserve's last meeting showed policymakers expect to start cutting back pandemic-era stimulus before the year is out. The dollar rose to a nine-month high.

- Pressure is rising on Big Tech firms, signalling tougher regulation in Washington and elsewhere that could lead to the breakup of big platforms. Yet shares of Apple, Facebook, Amazon and Google parent Alphabet remain near record highs, lifted by pandemic-fuelled surges in sales and profits.

- Lawyers for US solar manufacturers have petitioned Washington to investigate Chinese firms alleged to be circumventing tariffs by manufacturing in other countries including Thailand, Malaysia and Vietnam.

- The Chinese regulatory crackdown that has spooked investors still has a long way to run, says the Beijing think-tank China Labs. Since November, regulators have taken more than 50 actions related to antitrust, finance, data security and social equality, a Goldman Sachs study shows.

- While Chinese tech stocks are losing momentum because of a regulatory crackdown, the country's sportswear companies are racing ahead, giving investors an alternative consumer play as the government promotes exercise and healthier lifestyles.

- The return of more stringent travel restrictions in Hong Kong is likely to weigh on the city's battered hotel sector, which is expected to record among the slowest recoveries in Asia, analysts said.

- Toyota Motor Corp said it would slash global production for September by 40% because of the global chip shortfall, but it has maintained its annual sales target of 8.7 million cars for the year to March 31.

- British blue-chip firms last year slashed chief executive pay as the pandemic struck, but the head of the Covid vaccine maker AstraZeneca Plc still pocketed a table-topping £15.45 million, a survey showed.

- Oil prices were on track for a 5% weekly loss as demand concerns grew and the dollar strengthened to a 9-month high in response to Federal Reserve signals that it would start scaling back its stimulus.

- The National Economic and Social Development Council (NESDC) has downgraded its growth forecast for a third time to a range of between 0.7% and 1.2%, down from its May prediction of 1.5% to 2.5%, as Covid cases continue to surge.

- Thailand is heading for its first current account deficit since 2013, as it is missing out on the billions earned from tourism, piling more pressure on battered baht. The NESDC has estimated the shortfall at $10.3 billion, or 2% of GDP.

- Second-quarter GDP expanded 0.9% quarter-on-quarter, helped by exports and government spending, and at a better-than-expected 7.5% year-on-year, but third-quarter performance may be weaker given the extent of Covid restrictions.

- The Bank of Thailand is urging the government to borrow an additional 1 trillion baht to address the severe economic impact of the pandemic. But Finance Minister Arkhom Termpittayapaisith is cool to the proposal, saying the existing 500-billion-baht loan plan should be sufficient.

- Interest rates have become less effective managing the flagging economy, with financial measures and fiscal policy currently better tools, a member of the central bank's Monetary Policy Committee said at the last meeting. Meeting minutes also showed two members pushed for a cut in the policy rate to 0.25% from 0.50%.

- The Bank of Thailand plans to start testing its retail digital currency among the public in the second quarter of 2022 as an alternative payment option, an assistant governor said on Thursday.

- The Finance Ministry will link delivery service platforms with the government's two stimulus programmes in October to enable people to pay for the delivery of food or products via the schemes.

- The National Innovation Agency (NIA) has declared its intention to support 15 space-tech startups as part of its strategy to improve the deep-tech scene in Thailand over the next three years.

- The Industrial Estate Authority of Thailand (IEAT) plans to build a new industrial estate in Chachoengsao worth 4.85 billion baht in two years to serve new industries, including electric vehicle assembly.

- The government has launched a pilot programme to test, vaccinate and isolate factory workers to limit Covid-related disruptions to the export-driven manufacturing industry, one of the few bright spots in the economy.

- Tourism boosters hope as many as 500,000 Russian visitors could be added to an expected one million international tourists this year now that the Sputnik V vaccine has been endorsed for "sandbox" visitors, says the Tourism Authority of Thailand.

- Outbound tour operators expect increasing demand for vaccine tourism in the fourth quarter because of the delay in procurement of high-quality vaccines in Thailand.

- Thai car exporters' prospects have become brighter after the Philippines scrapped plans to impose tariffs on cars imported from Thailand.

- The retail IT sector in Thailand is gravitating towards online sales, with half of distributors' revenues expected to come from online channels by 2023, says the distributor Advice IT Infinite.

- China allowed 56 longan packaging companies to resume exporting Thai longan to China on Aug 17, reversing a ban imposed on Aug 13, according to the Commerce Ministry.

- The oil and gas conglomerate PTT Group says it intends to maintain the momentum of its new business development, including electric vehicles (EVs), over the next five years.

- The 7-Eleven operator CP All Plc remains committed to adding around 700 new stores this year with projected capital expenditure of up to 12 billion baht, despite the ongoing negative impacts of pandemic restrictions and curfews.

- Online food delivery competition in Thailand is expected to intensify with AirAsia Group's launch of its super app and the rollout of its "airasia food" delivery service.

Coming up: Germany, the US, France, Japan, Australia and the euro zone will all release manufacturing data on Monday. Germany will release second-quarter GDP on Tuesday, Thailand will release July trade figures and the US will release July new home sales.

- The US will release July core durable goods orders on Wednesday and revised second-quarter GDP on Thursday. The same day, the US Federal Reserve opens its annual Jackson Hole Symposium, which runs until Saturday. Thailand will release July industrial production figures.

- Australia will release July retail sales on Friday. The US will release personal consumption expenditure and trade updates.

Stocks to watch: UOB Kay Hian Securities recommends short-term investment in communications and REITs as both sectors remain a comfort zone amid growing worries over likely downgrades to H2 earnings forecasts. Top picks include ADVANC, DTAC, FTREIT, WHART, RATCH, EASTW, WHAUP, TTW, TVO, TU, CPF, GFPT and TWPC.

Capital Nomura Securities recommends stocks expected to outperform such as GPSC, GULF, BCPG, BDMS, BH, ADVANC, KCE, HANA, SAPPE, TOP and PTTGC. Stocks expected to announce interim dividends are TVO and LH.

Technical View: Maybank Kim Eng Securities sees support at 1,515 points and resistance at 1,565. Thanachart Securities sees support at 1,530 and resistance 1,567.