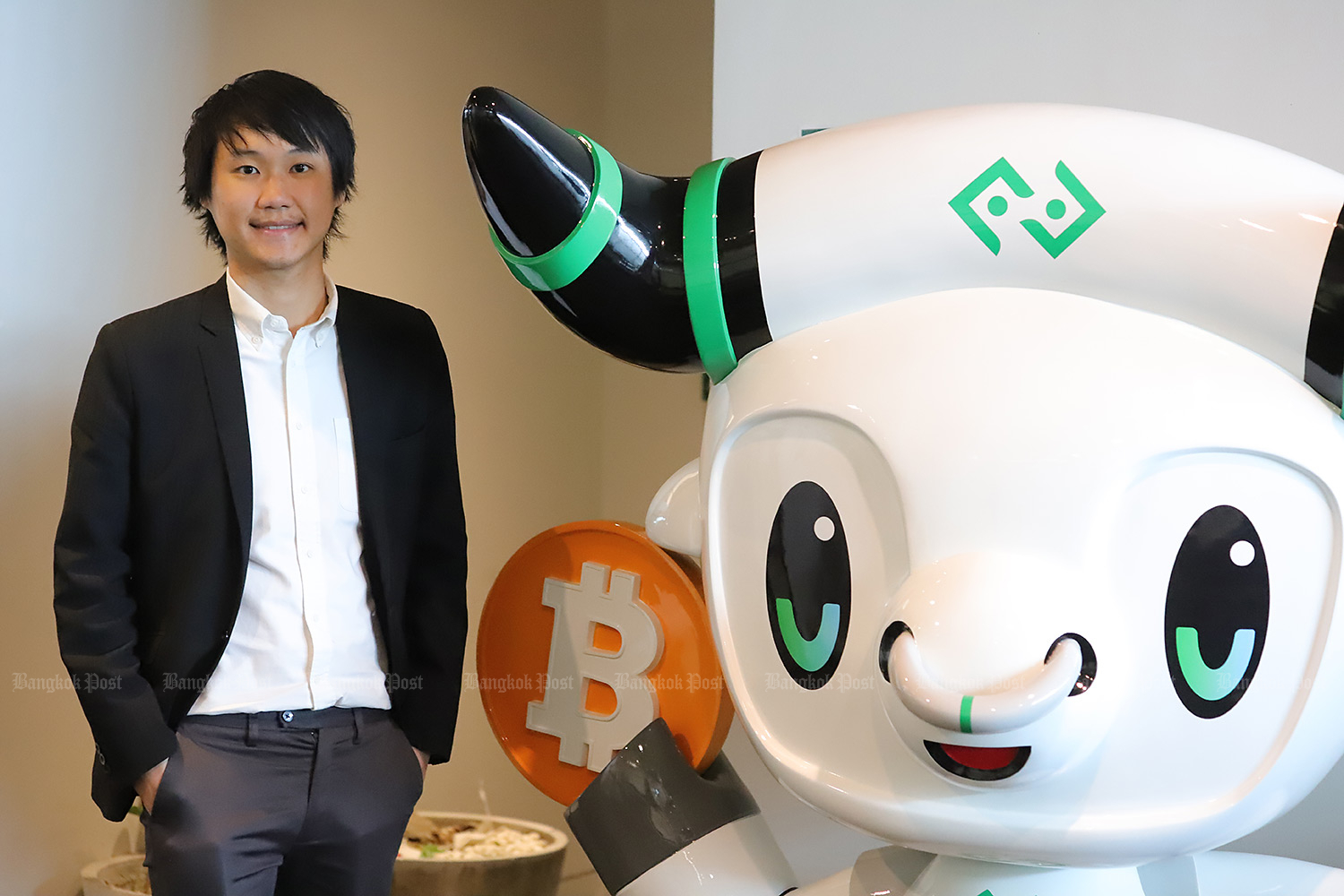

Bangkok-based Bitkub Capital Group Holdings Co has been in talks with prospective local partners in Southeast Asia regarding plans to expand beyond Thailand next year, says founder and group chief executive Jirayut Srupsrisopa.

In an exclusive interview with the Bangkok Post, Mr Jirayut said the company is studying different countries in the CLMV (Cambodia, Laos, Myanmar and Vietnam) region for Bitkub to "launch its next operation".

"We are eyeing international expansion," he said. "We already conquered Thailand. Our next goal is to be a national champion, go to other countries and bring revenue back to the country."

To expand its business overseas, Mr Jirayut said it's very important to find the right local partner.

"Bitkub is not a common company. We do not sell shirts online. We need to create an infrastructure that would be critical for that country," he said.

"We have to find a really strong local partner to work with. We just can't go by ourselves and create an infrastructure for that country."

Mr Jirayut said Bitkub expects the expansion to another country to happen next year. The company claims to be the No.1 digital asset and cryptocurrency exchange platform in Thailand.

"I hope everything goes according to plan. If so, we can start to expand next year, but not aggressively. It would be a very modest expansion because we need to keep cash," he said.

In late August, Siam Commercial Bank and Bitkub announced a plan for Thailand's oldest lender to acquire a controlling stake in Bitkub Online for 17.8 billion baht had been scrapped, citing regulatory issues surrounding the cryptocurrency exchange.

Mr Jirayut was recently quoted as saying Bitkub is seeking to list on the Hong Kong Stock Exchange.

"I hope we will be a publicly listed company eventually. If the environment is appropriate and the regulations allow it, we would love to be a publicly listed company," he said.

Bitkub has 1,000 employees and has been posting a profit since its inception because it has no debt, said Mr Jirayut.

He said last year Bitkub registered a net profit of US$100 million with a price-to-earnings ratio (PE) of 13.

"We are already a sizeable company. We are not a startup and we have zero debt. We don't like to run the company on debt," said Mr Jirayut.

In addition to foreign expansion, he said Bitkub's strategy for 2023 is to maintain cash, reduce unnecessary spending and develop new products.

"During the 'crypto winter' the best strategy is to keep cash and quietly build products as well as larger infrastructure ready to capture growth in the next cycle," said Mr Jirayut.

The next Bitcoin cycle is expected in 2024, which some analysts foresee as the next "golden year" for the industry.

"Every four years, there is a golden year for Bitcoin. We believe the next wave will be after May 2024," he said.