Many of you might be waiting to read about an effective "helicopter money" policy to boost the Thai economy as I mentioned in my previous article. Of course, I have reached my conclusion on that strategy but I beg readers to wait and read today's article first. The reason is that without properly understanding the "real" economic problems, a demand-stimulating policy such as helicopter money would become useless and could do more harm than good.

I accidentally discovered a hidden problem of the Thai economy when I was doing a quarterly economic assessment for a research firm. It is a no-brainer that the economy has been weakening despite the government's propaganda. A sharp dip in the first-quarter GDP to 2.8% is therefore expected. As a matter of fact, I project 2019 GDP growth to come in at merely 1.2%. The 3%-plus growth projections are all far from realistic.

When I was doing the assessment, I kept asking myself why the Thai economy has been constantly weakening and has been very sensitive to export demand. The Bank of Thailand's (BoT) export growth figures, which show sharp drops in the first half of 2018 and in the first quarter of this year, bother me greatly.

I previously believed that the weakening of the Thai economy was caused by domestic factors such as high household debt, low wages and low crop prices. In other words, Thai consumers have less and less money to consume and keep pulling down the economy with them. A policy such as helicopter money aiming to provide more spending power to consumers is a clear solution.

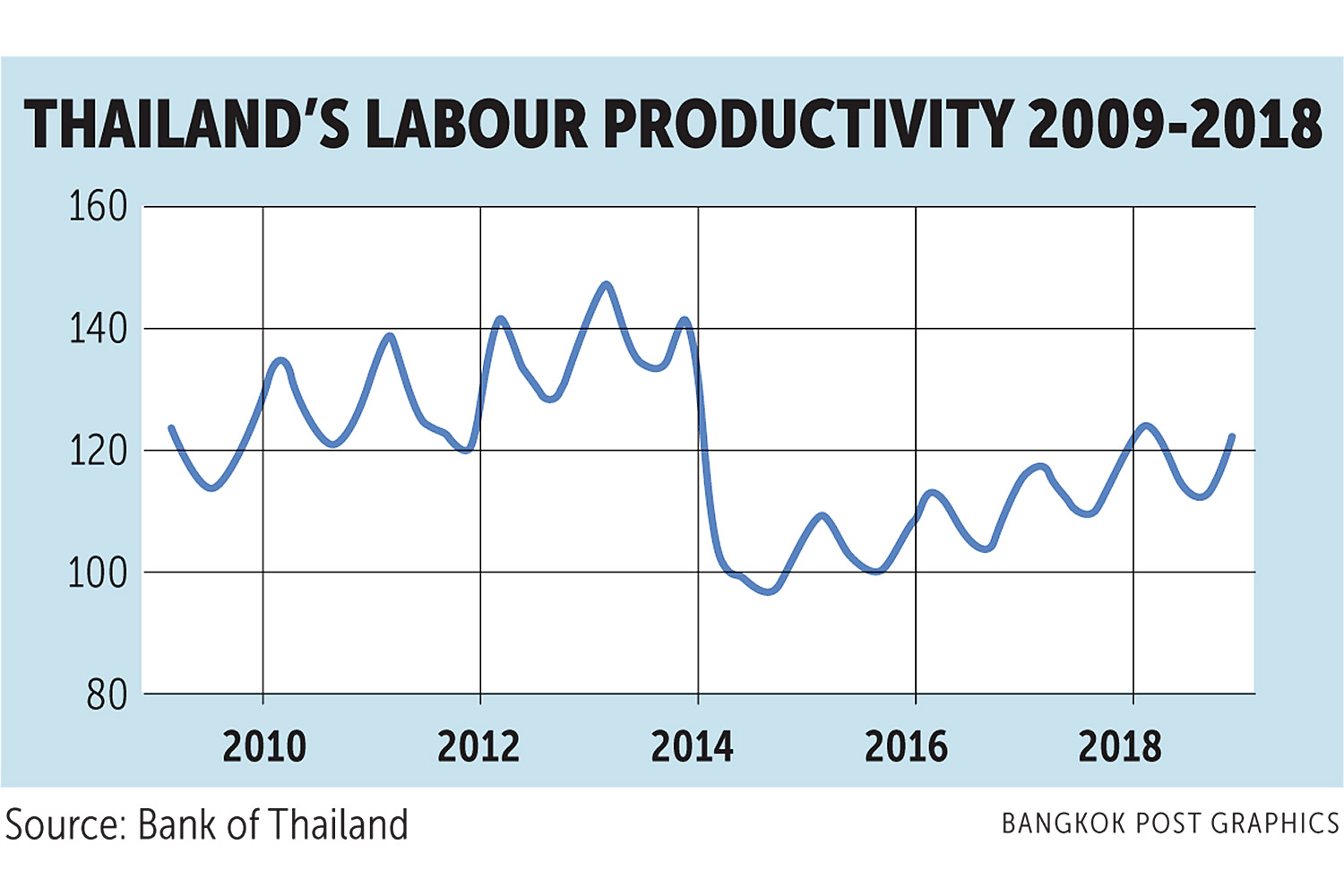

But the BoT's export growth figures have caused me to rethink demand-stimulating policies. If all the causes of the weak economy are internal ones, there should not be a sharp drop in export growth. It is easy to blame the slowdown on the world economy and the US-China trade war. But the marked slowdown in exports started in the second half of last year and deteriorated quickly after that. That is way before the recent trade war began in May of this year. And the world economy has only gradually slowed down, not abruptly. There has to be another explanation. Then I looked at the competitiveness issue and I found alarming figures regarding Thailand's decreasing labour productivity.

One could tie the drastic drop in labour productivity to political events over the past years, but I will not. What I will say is that in the last five years Thailand has lost 20.6% of its labour productivity, which makes the country less competitive in the global market. Combined with the recent appreciation of the baht, the international competitiveness of Thailand is 30-40% lower. Therefore, when world demand turns around, Thailand will be hardest hit as shown in the BoT's figures as we are a high-cost producer. With the complications of the trade war, Thai exports are most likely to take a harder hit. To hope that the Thai economy will rebound in the second half of this year is simply pointless.

Before we get to the consequences of the loss in labour productivity, let's determine the causes. I'd have to look at detailed figures -- industry by industry -- to determine the exact causes, and I don't have either the luxury of time to do this or access to detailed data. But I would not be wrong to say that it is caused by a lack of capital investment to upgrade technology and production facilities over the past five years. Of course, there is no denying that lower domestic demand for output is also one of the main causes. Why has there been no capital investment to upgrade the Thai production system? Now one can tie in political events.

What is done cannot be undone. No point in whining. One must focus on the fact that the Thai production system is no longer globally competitive and the situation will get even worse as there continues to be no private capital investment. And, according to my sources, many factories have moved production bases to other countries because it is more cost-effective to build new factories elsewhere than to upgrade facilities in Thailand. I fear that many more will follow suit.

There are three markets in an economy -- the financial market, the product market, and the labour market. The reaction in the first market is instant and violent as we have seen in all financial crises around the world. It is difficult to predict the timing and magnitude of a financial crisis. The product market takes three to six months to adjust. The crisis will not be violent but will happen slowly. Looking at the BoT's export growth figures, it could be said that the Thai product market is currently adjusting, ie, factories are cutting production. The labour market takes six to 12 months to adjust, ie, lay-offs will happen about six months after a production cut. If one believes these adjustment timelines, massive layoffs could happen six months from now.

In light of both the demand and supply problem, a demand-stimulating policy such as helicopter money is needed even more. It is needed not only to stimulate the economy but stop a vicious cycle from happening. The vicious cycle is this. Low demand leads to low production. Low production triggers layoffs. Layoffs cause even lower demand. Lower demand results in lower production. Lower production translates to more layoffs.

And what type of helicopter money policy is needed? Next time then.

Chartchai Parasuk, PhD, is a freelance economist.